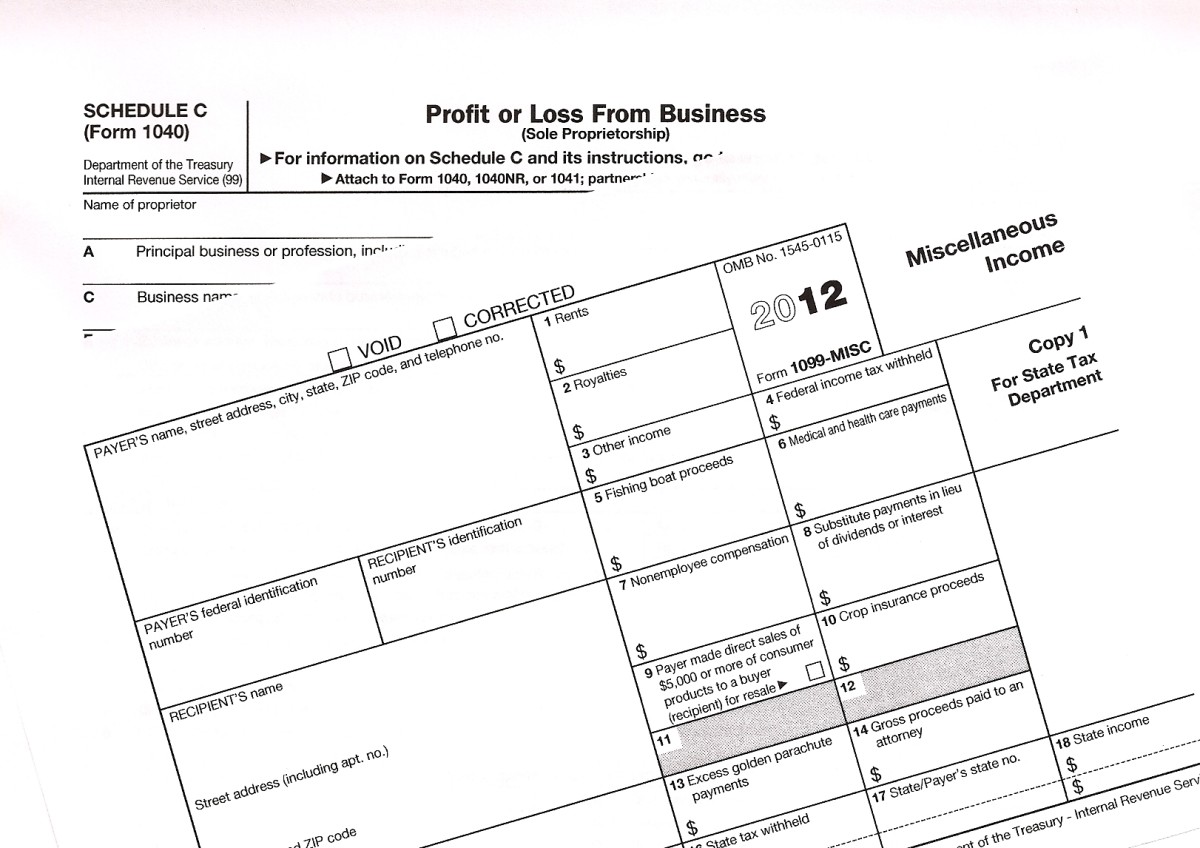

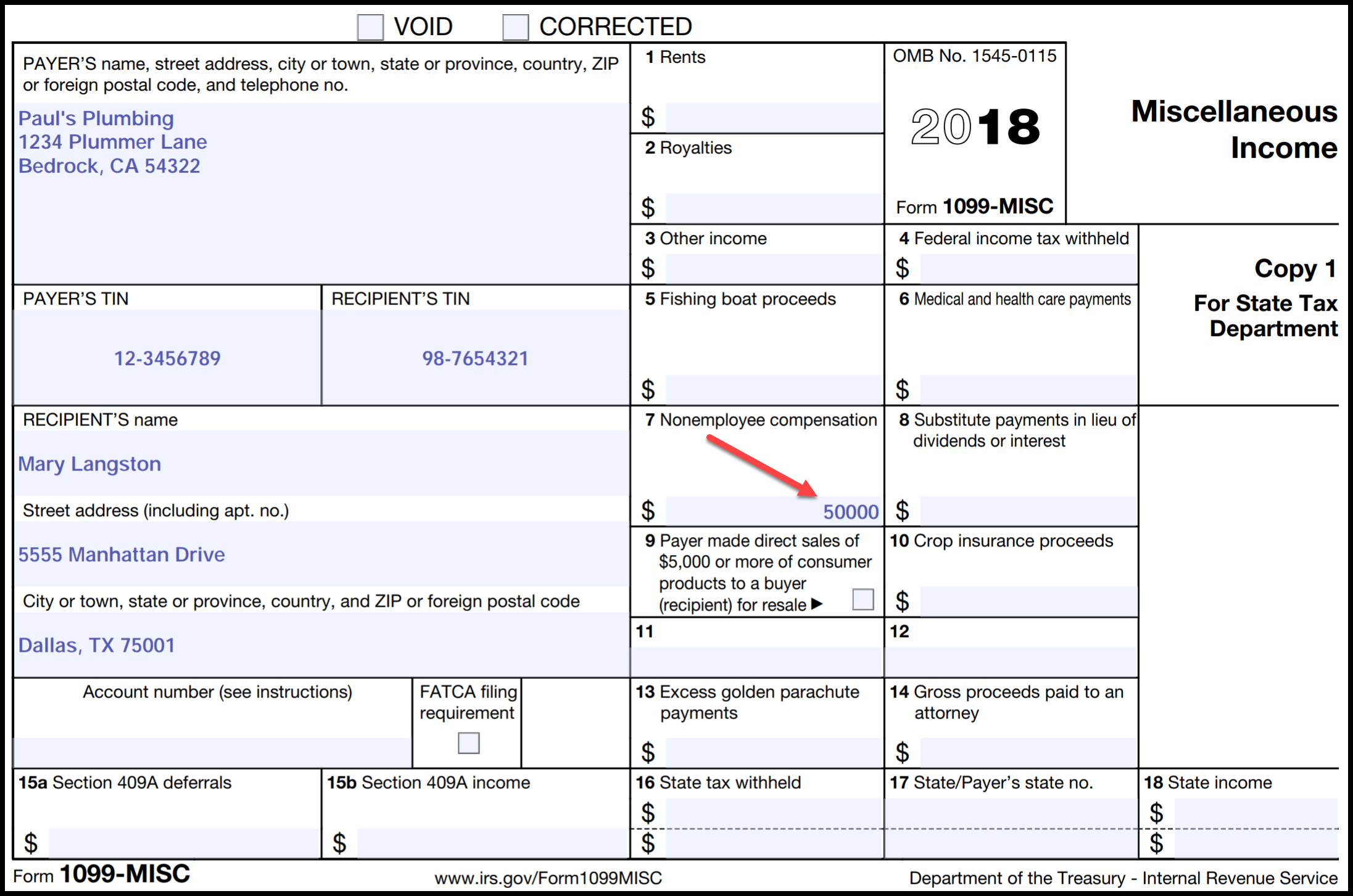

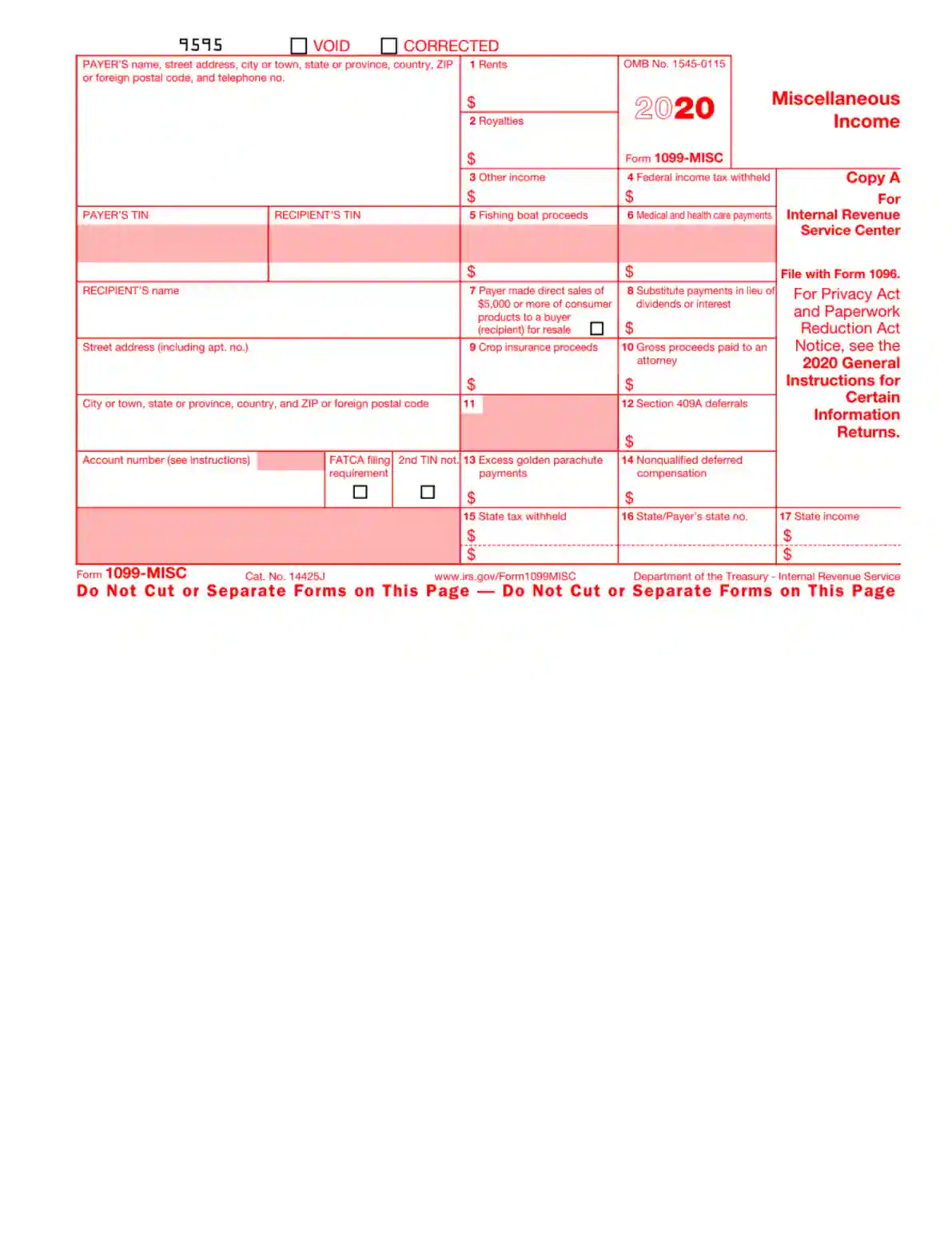

1099 NEC Form 22 Form 1099NEC, Nonemployee Compensation is the information return that reports to income paid to individuals and businesses that are not the employee of the company Whenever you make a payment to a freelancer or a contractor, you need to furnish them with an information report that reports the income paid to themWhile some states require all businesses to have a license, others may require it depending on what kind of work you do1099 MISC IRS Form is especially useful for businesses and individuals that have a significant number of contractors working for them In the case of a businesstobusiness transaction, IRS Form 1099MISC can be used to report payments to freelancers or independent contractors

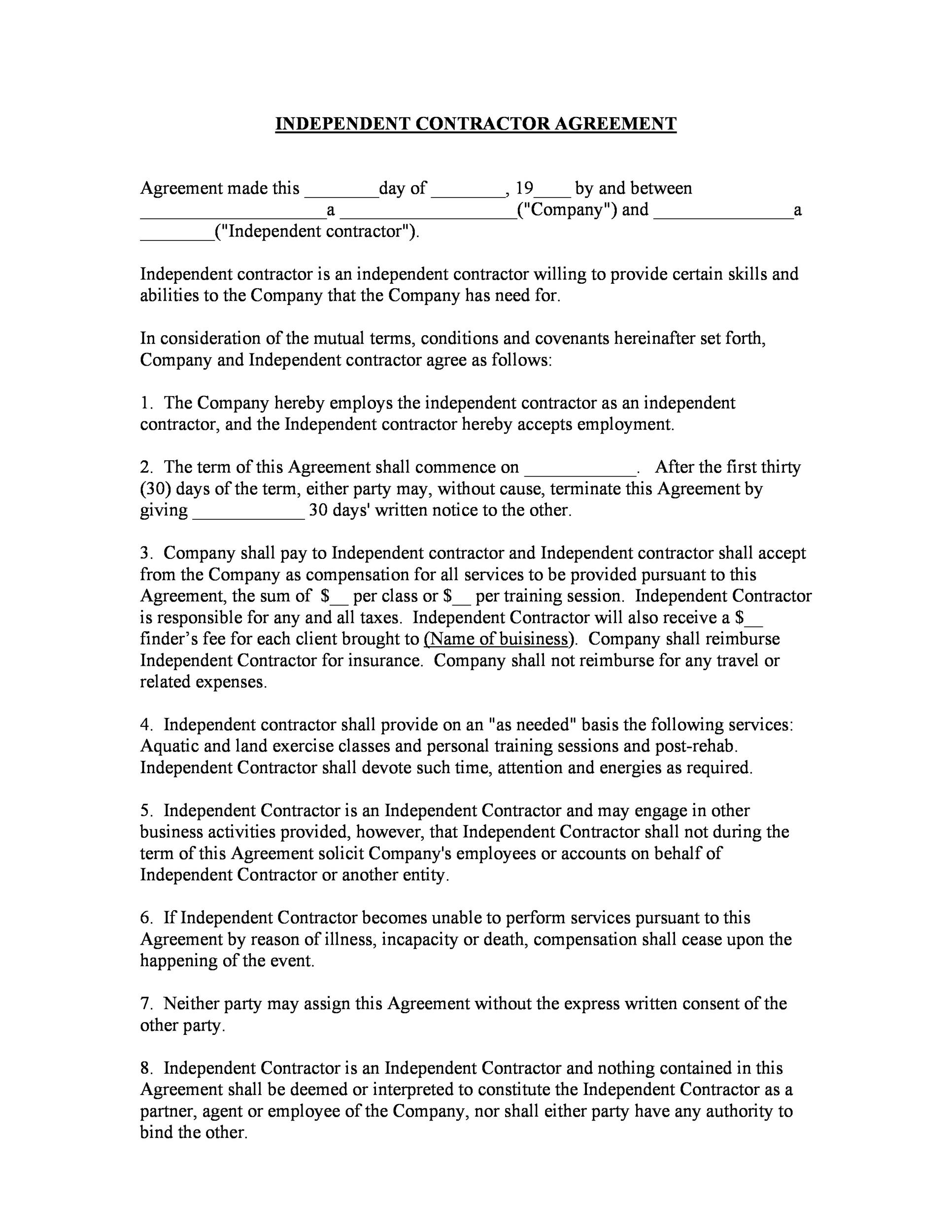

Independent Contractor Agreement For Programming Services Template By Business In A Box

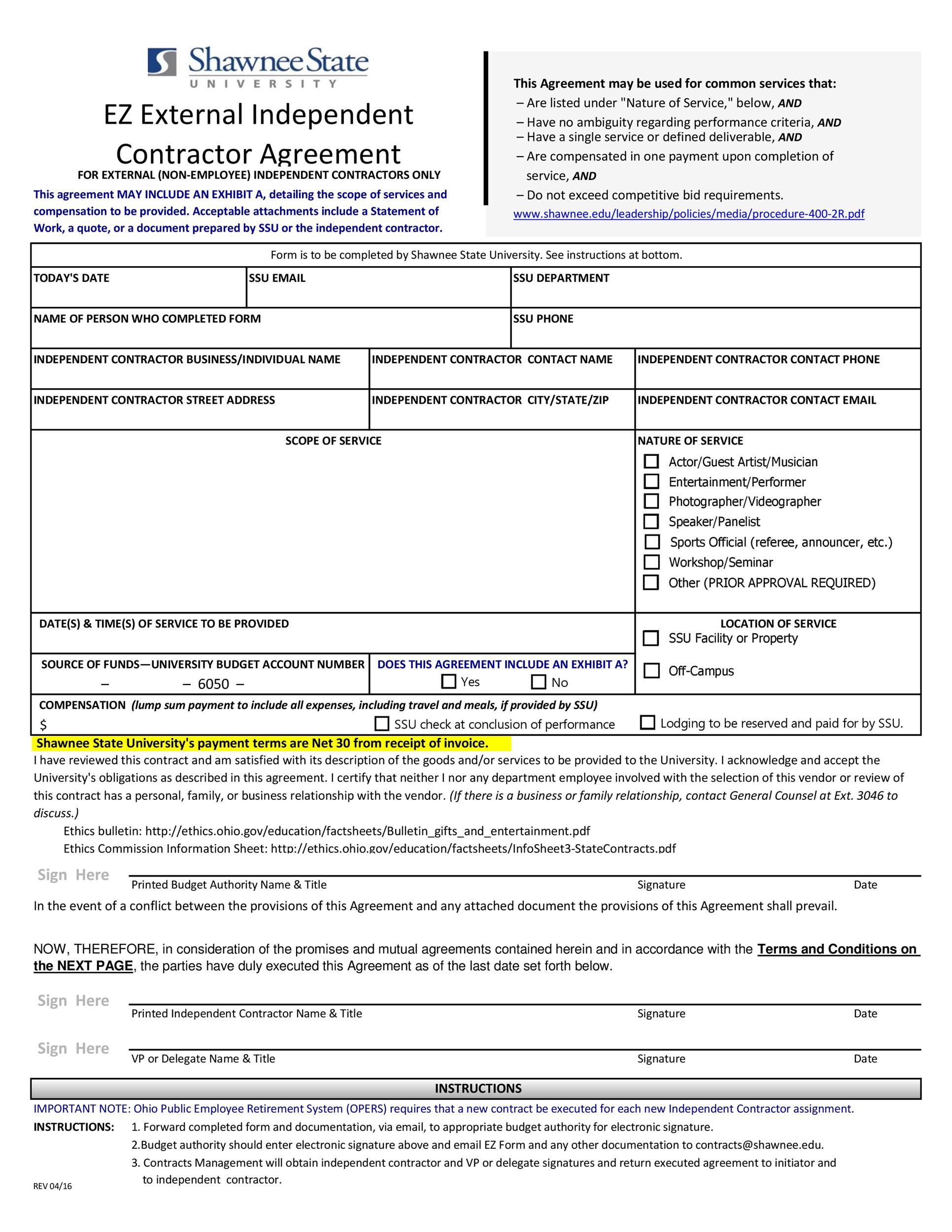

1099 contractor agreement form

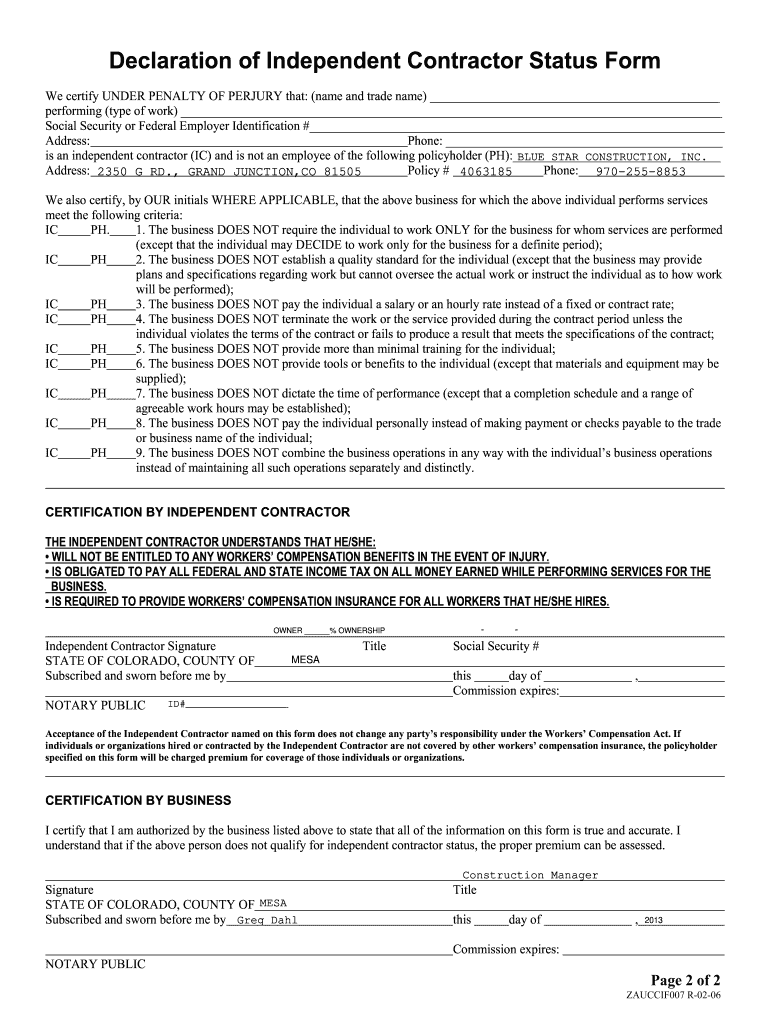

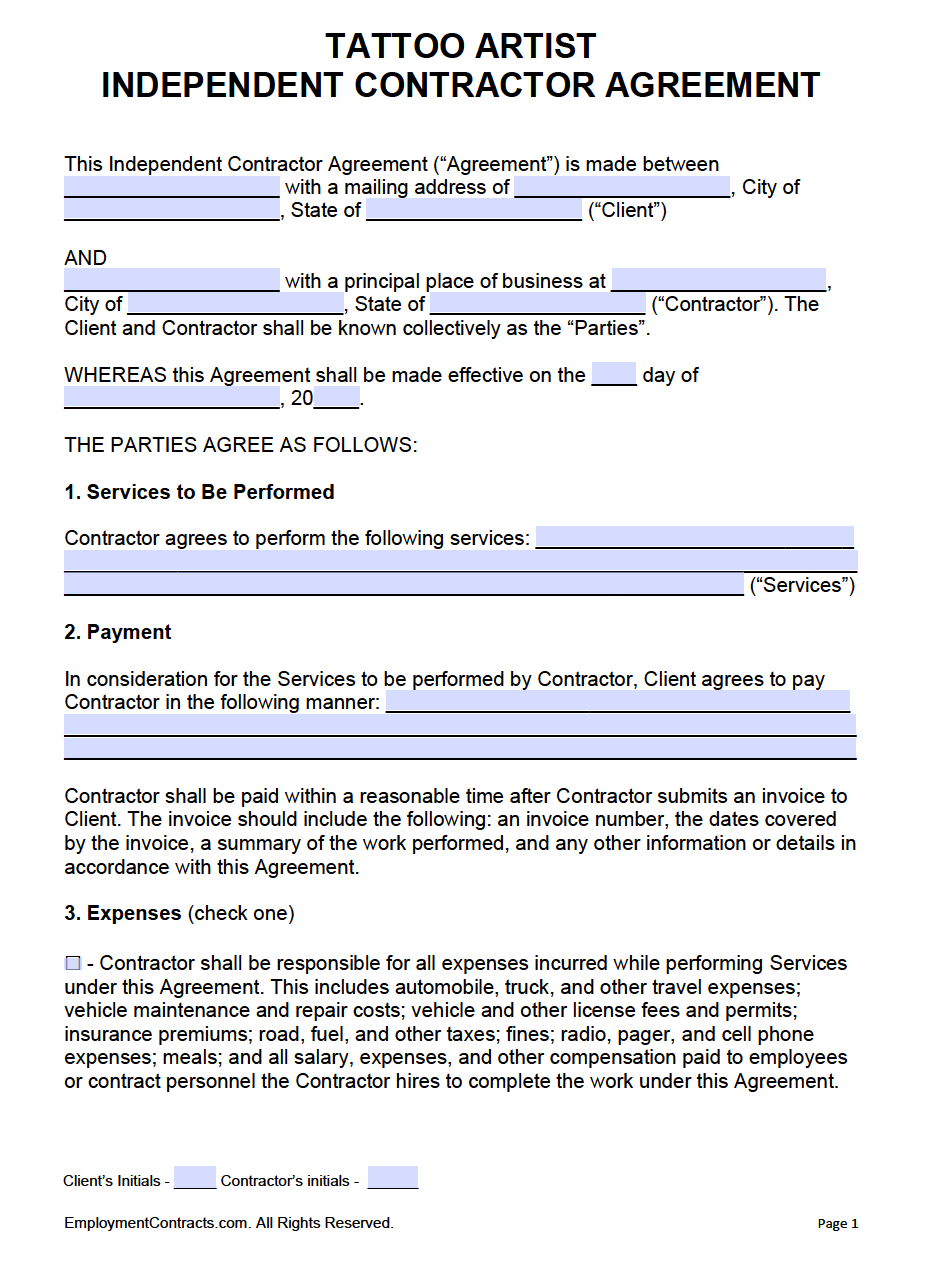

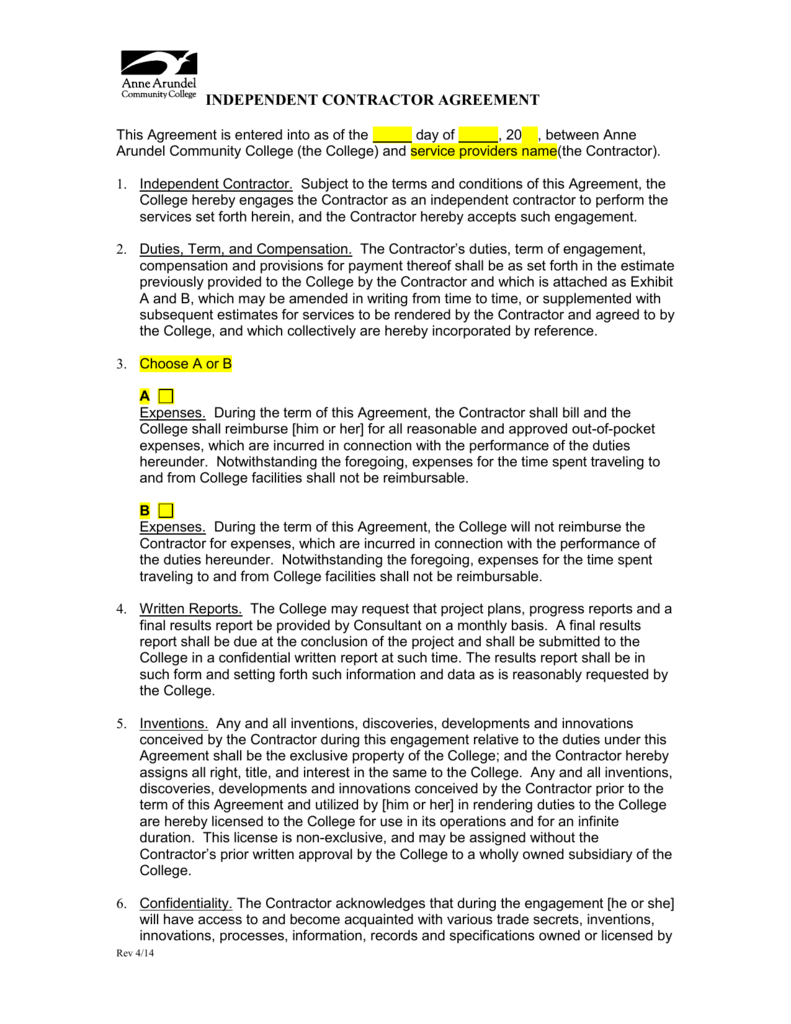

1099 contractor agreement form- A 1099NEC form is used to report amounts paid to nonemployees (independent contractors and other businesses to whom payments are made) Nonemployees receive a form each year at the same time as employees receive W2 forms—that is, at the end of January—so the information can be included in the recipient's income tax returnContractors receive agreedupon fees for services provided to the client without any withholdings for tax purposes Companies that pay an independent contractor $600 or more for services provided during the year must provide the contractor with a Form 1099

Acknowledgment Of Independent Contractor Template By Business In A Box

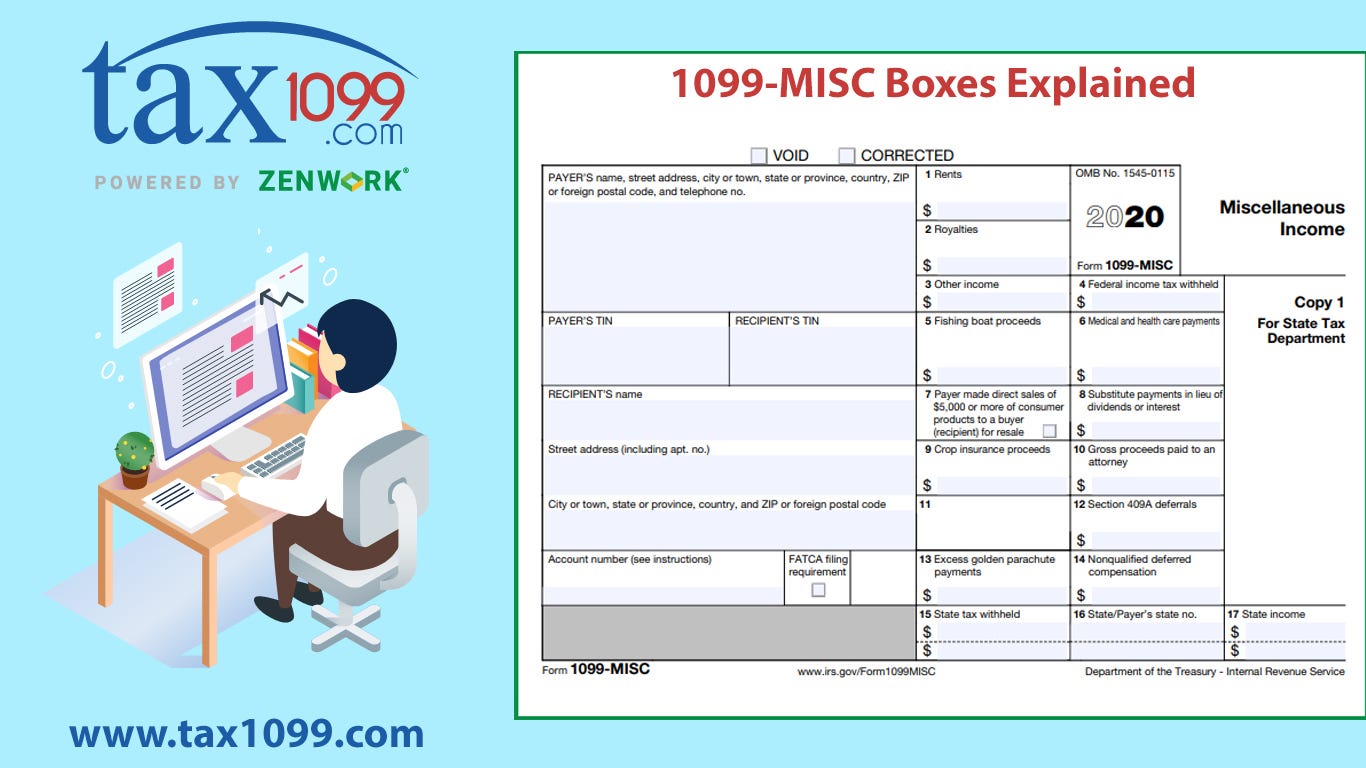

What Is a Form 1099MISC? Form 1099 comes in various versions, depending on the payment type It can be required of you if you paid someone $600 or more during the tax year Does an Independent Contractor Need a Business License? What Is the Difference Between 1099 and W2?

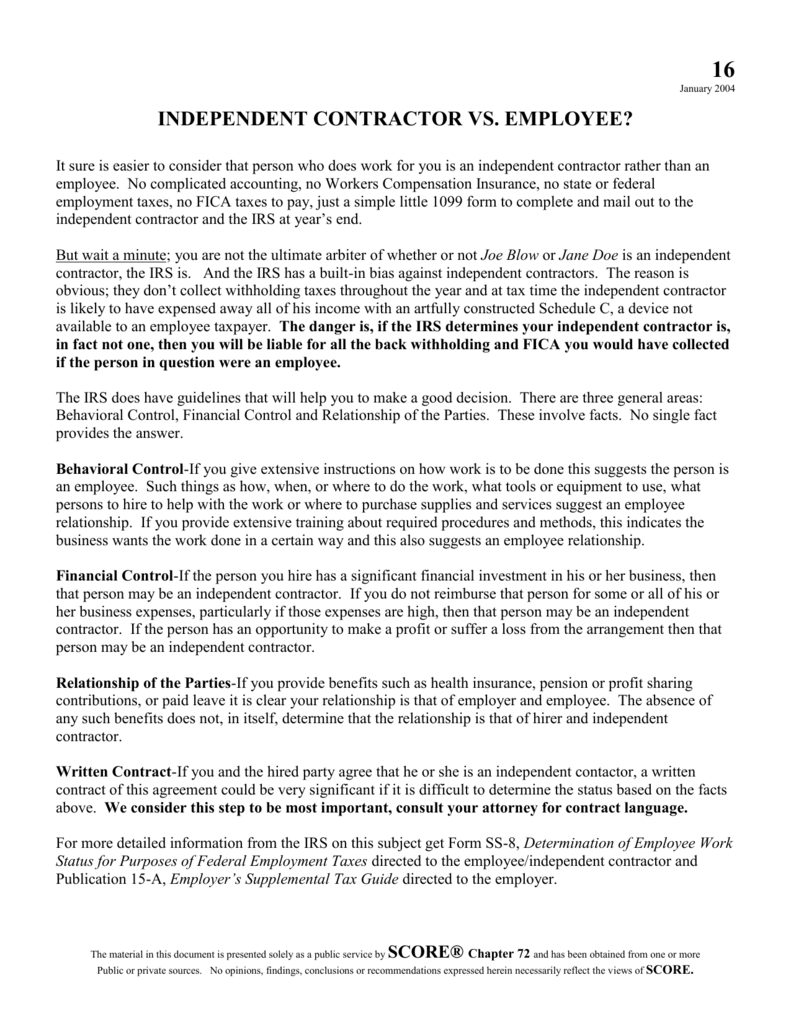

The Social Security Administration shares the information with the Internal Revenue Service Payers use Form 1099MISC, Miscellaneous Income or Form 1099NEC, Nonemployee Compensation to Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC)A 1099 contractor, also known as an independent contractor, is a classification assigned to certain US workers The "1099" reference identifies the tax form that businesses must file with the Internal Revenue Service ( IRS ), and it relieves the employer from the responsibility of withholding taxes from the individual's paychecks Taxpayer ID Numbers for Form 1099NEC You must have a valid tax ID number for a nonemployee before you prepare Form 1099NEC When you hire a nonemployee, you must get a W9 form from them reporting this and other identifying information you'll need to complete Form 1099NEC Document your efforts to obtain a completed W9 form by keeping

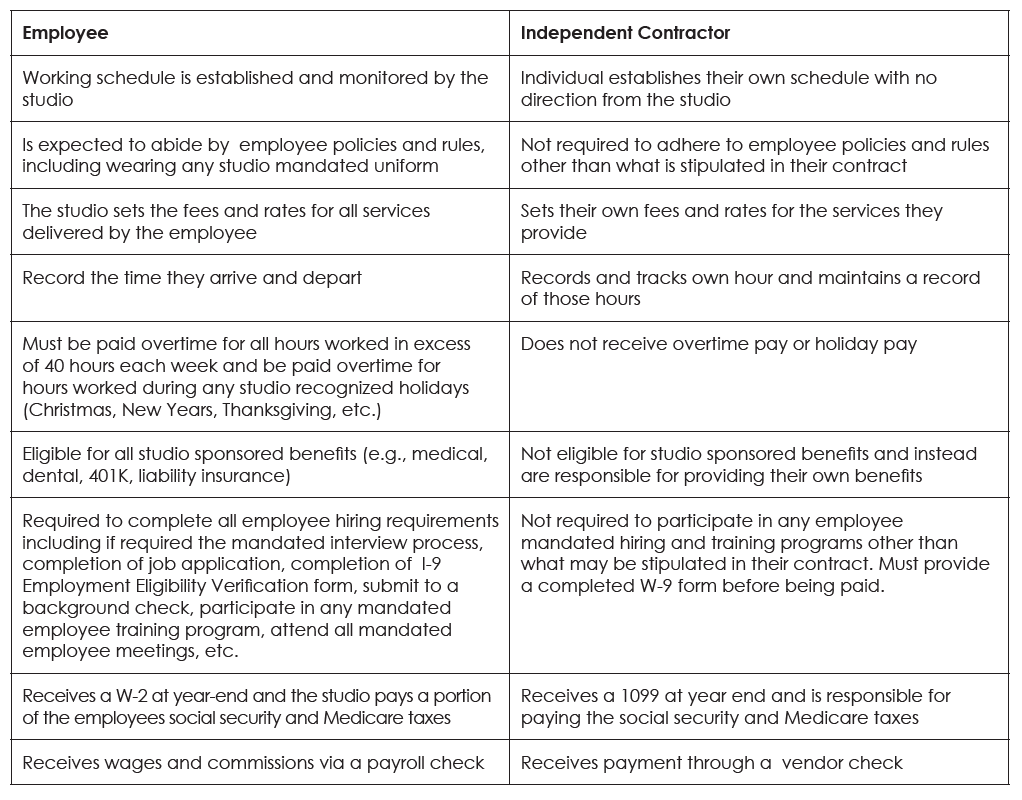

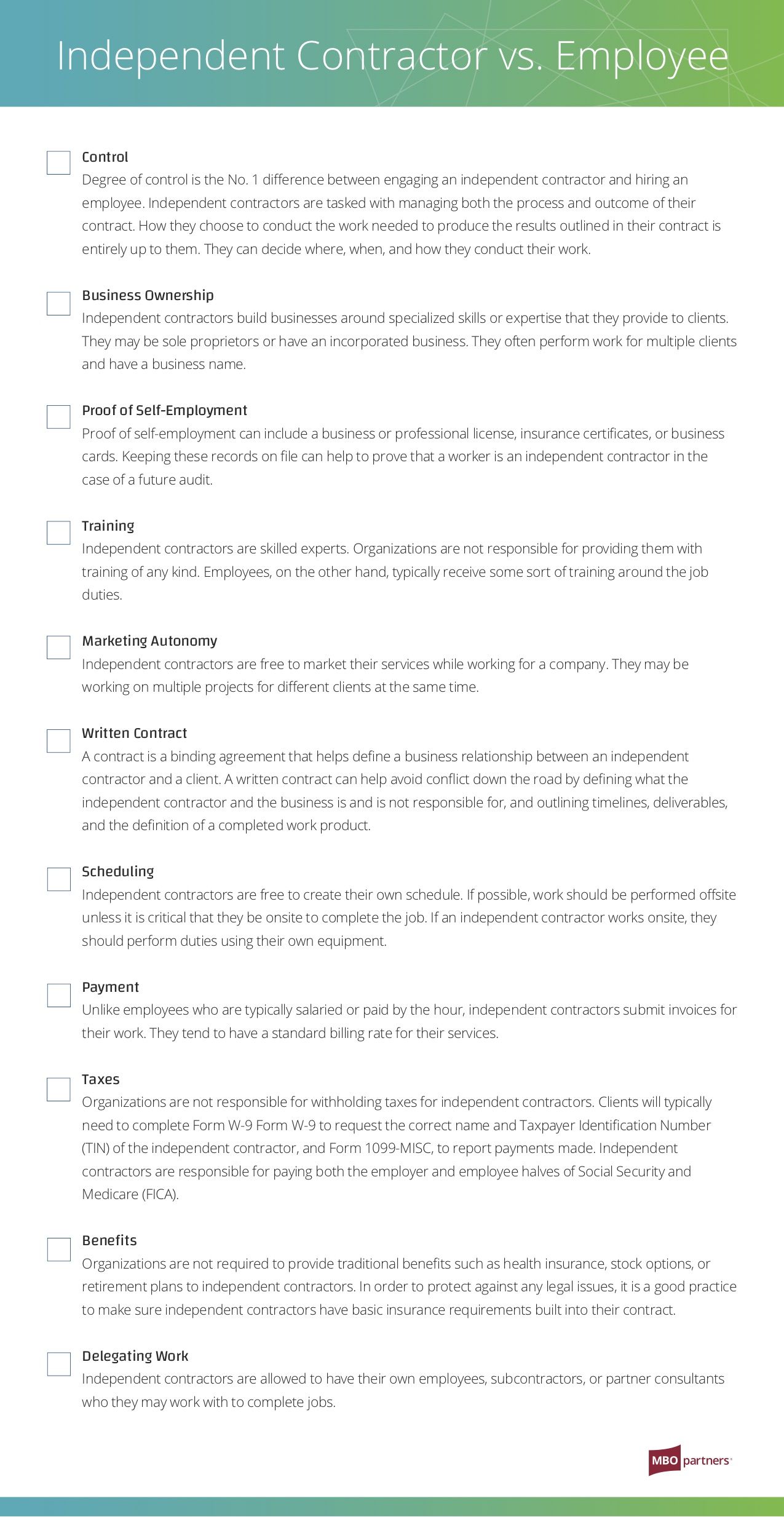

Form 1099MISC is due When these conditions apply Jan 31, Due to recipients if there's data in box 7 for nonemployee compensation Feb 28, Due to recipients if you do not have nonemployee compensation and you file on paper Feb 28, Copy A due to IRS if you're filing manually and box 7 is emptyImportant Facts About Employee Classification Employers are responsible for classifying workers correctly A worker who is called contract labor and whose wages are reported using IRS Form 1099 may not be an independent contractor Neither the business nor the individual may choose whether the worker is classified as a contractor or employee Keep all invoices on file, and make sure they coordinate with Form 1099MISC Independent Contractor vs Employee If you are not sure whether the individual is an employee or an independent contractor, the IRS, US Department of Labor, your State Compensation Board, your State Workers' Compensation Insurance Agency, and your State Department

Pin On Online File Taxes

Independent Contractor Billing Template Awesome Independent Contractor Invoice Invoice Template Ideas Invoice Template Invoice Example Invoice Template Word

Return to the earlier query Once you know which contractors you paid over $600 to, you will need to fill out Form 1099NEC Starting at the upper left box, record your organization's name as the PAYER The PAYER TIN is the organization's tax identification number The RECIPIENT'S TIN is the contractor's SSN or business TIN 1099 Contractors and Freelancers Most sharing economy workers are 1099 contractors for tax purposes However, you can avoid 1099 contractor status if you formed a corporation for your business The IRS taxes 1099 contractors as selfemployed If you made more than $400, you need to pay selfemployment tax

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

Employee Or Independent Contractor Which One Is Best For My Business The Association Of Fitness Studios

The Social Security Administration shares the information with the Internal Revenue Service Payers use Form 1099MISC, Miscellaneous Income or Form 1099NEC, Nonemployee Compensation to Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Simply upload your W9s and we'll file and mail the 1099s for each contractor Form W9 (Request for Taxpayer Identification Number) starts easy by verifying your freelancer's name and address Next, Box 3 (at the top of the form) will letYou are likely an independent contractor if you performed work for a business, individual, or any other organization and you received a 1099MISC form for your work As an independent contractor, you are engaged in business in Washington You must register with and pay taxes to the Department of Revenue (DOR) if you meet any of the following

It S Irs 1099 Time Beware New Gig Form 1099 Nec

What Is A 1099 And Why Did I Get One Toughnickel

Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade When issuing a 1099 misc does it include only labor or include expenses reimbursed to contractor Actually, in the instructions for the Form 1099MISC the IRS provides this guidance Specific Instructions File Form 1099MISC, Miscellaneous Income, for each person in the course of your business to whom you have paid during the yearThe 1099 form is for businesses If a contractor does work for you in your private home, it's his responsibility to report the income Even if the same person painted your house and

Tax Deductions For Independent Contractors Kiplinger

Free Washington Independent Contractor Agreement Word Pdf Eforms

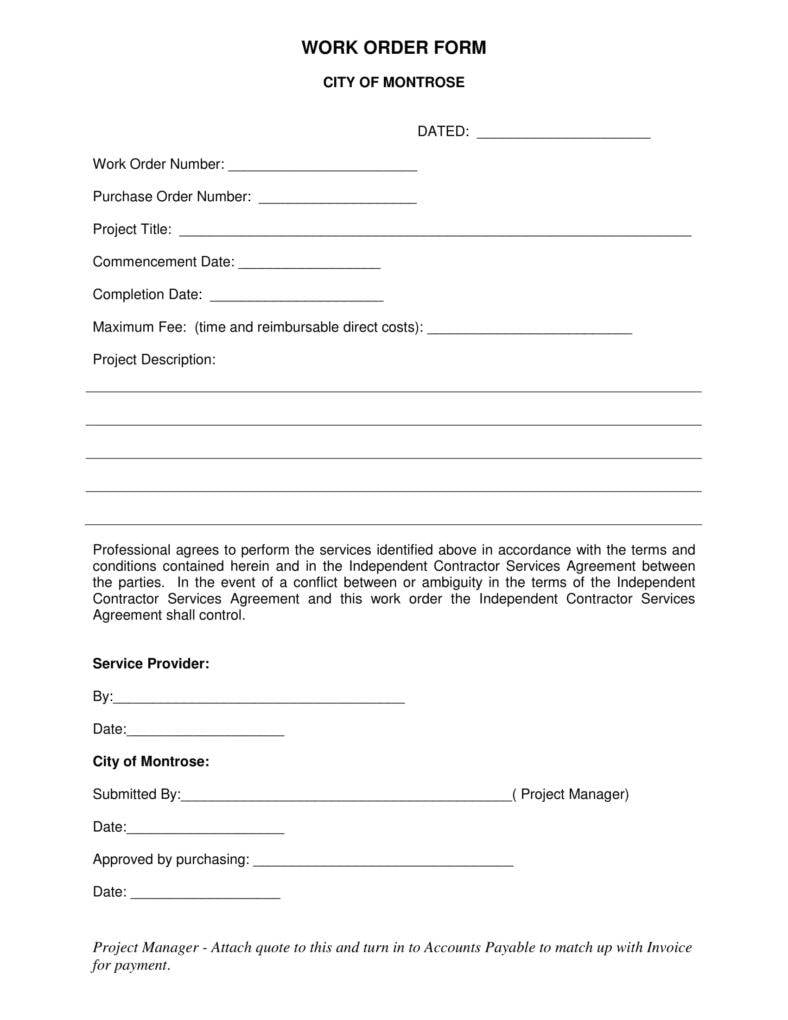

1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Massachusetts Corporation with its principal office at 44 School Street, Boston, MA ("Eastmark"), and each Project by the execution by Eastmark and Contractor of a Work Order in the form attached to As per the IRS rules, independent contractors must pay 90% of taxes or the equivalent of 100% of last year's tax bill by December Form 1099 online is an IRSauthorized efile provider which helps to report the income paid to the contractors with the respective 1099 Tax Form We provide stepbystep guidance to file tax returns easilySince an independent contractor doesn't receive a W2 form for paying taxes, they will receive a 1099 form, which shows no tax deductions This is because they are responsible for paying their own selfemployment tax like Medicare and Social Security, in addition to personal income tax

Images Template Net Wp Content Uploads 16 03 Independent Contractor Commission Agreement Pdf

Everything You Need To Know About Paying Contractors Wave Blog

You are required to file a Nonemployee Compensation Form (1099NEC) or a Miscellaneous Information Form (1099MISC) for the services performed by the independent contractor You pay the independent contractor $600 or more or enter into a contract for $600 or more The independent contractor is an individual or sole proprietorshipForms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying12 1099misc form A 1099 contractor is a legal and taxrelated term used in the United States to refer to the type of worker who contracts his services out to a business or businesses These contractors exist in multiple fields — from hospital planners, to marketing consultants, to building contractors, to freelance writers

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Popular Form 1099R Versions & Alternatives Form 1099A Online 1099A is a tax document that reports the annual gross proceeds from a business or from a sale of a property 1099A is used for both business and other income For example, if a person rents out a property, they may be required to submit a 1099A for that incomeFor 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter CONTRACTOR shall be an independent contractor and shall be solely responsible for payment of all taxes and/or insurance as required byA Form 1099MISC is an IRS form that reports nonemployee compensation In addition to reporting compensation to freelancers and contractors, this form covers received income that spans the gamut from rents and crop insurance proceeds to prizes and awards, medical and health care payments, and any fishing boat proceeds

3

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Employed by a contractor providing contract services (such as employee leasing or temporary agencies) and are providing labor to you; 2 IRS Tax Form 1099NEC As of the tax year, the IRS Form 1099NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting incomeYour company should have a checklist in place for 1099 contractors as well as an uptodate filing system to keep track of the records each contractor submits with their contract Each contract should be treated separately, even if you've used the same contractor a hundred times

50 Free Independent Contractor Agreement Forms Templates

Instant Form 1099 Generator Create 1099 Easily Form Pros

Payments through thirdparty networks, including credit card payments, are reported on Form 1099K If, for example, a business pays an independent contractor through PayPal, the contractor may receive a Form 1099K from PayPal for those direct sales Issuing a 1099K depends on the number of transactions and the total dollar amount paidContractors often cost more per hour than employees with equal experience and training However, because you only pay for hours worked, using a contractor is sometimes the most economical option However, the same IRS disclosure rules apply You still need to report your contractor's earnings each year on a 1099 form vs a W2 form for employeesForm 1099NEC as nonemployee compensation Any amount included in box 12 that is currently taxable is also included in this box This income is also subject to a substantial additional tax to be reported on Form 1040, 1040SR, or 1040NR See the Instructions for Forms 1040 and 1040SR, or the Instructions for Form 1040NR Boxes 15–17

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

Declaration Of Independent Contractor Status Form Fill Online Printable Fillable Blank Pdffiller

Do file a 1099 for impartial contractors and unincorporated companies to whom you paid over $600 in a single tax 12 months Don't file a 1099 for workers You'll report your staff' wages, ideas, and different compensation on a Kind W2 Unsure whether or not somebody is a contractor or an worker? Compensation — enter the total previous payments to be reported in Box 7 of Form 1099MISC Reimbursement — enter businessrelated expenses prepaid by the contractor that you paid back to them Any amounts entered here are not reported on Form 1099MISC Select OK Enter the contractor's bank account info then select OK Independent Contractor Defined People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors However, whether these

I Received A Form 1099 Misc What Should I Do Godaddy Blog

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

Businesses use the information on your Form W9 to file your Form 1099NEC, which reports payments made to independent contractors that exceed $600 for the yearOr Not physically working on US soil If you are selfemployed, you do not need to complete Form I9 on your own behalf unless you are an employee of a separate business entity, such as a corporation or A 1099 form is a tax document filed by an organization or individual that paid you during the tax year "Employees get W2s or if you sold your services as an independent contractor You may

Sample Independent Contractor Non Compete Agreement Word Pdf

Freelance 1099 Tax Form Explained 7 Must Know Facts

File 1099 online securely with our efile for business service Print, mail, and file 1099, W2, 1098 & 1042S tax forms to recipients without software IRS approved A 1099 is an "information filing form", used to report nonsalary income to the IRS for federal tax purposes There are variants of 1099s, but the most popular is the 1099NEC If you paid an independent contractor more than $600 in a financial year, you'll need to complete a 1099 Independent, or 1099, contractors run their own businesses A properly classified independent contractor is allowed to set their own hours, decide from where to work, and are allowed to negotiate payment When you work as a 1099 contractor, you have to think of the businesses who you do work for as your clients, rather than your employer

Independent Contractor Or Employee

1099 Form Irs 18

You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files

Exh10 1 Htm

3

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Www Alaska Edu Controller Acct Admin Manual Acct And Finance E 01 Pdf

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Irs 1099 Misc Form For 21 Form 1099 Online By Form1099 Issuu

Newportbeachca Gov Home Showdocument Id

Independent Contractor Contract Template Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

All About Forms 1099 Nec And 1099 K Brightwater Accounting

Free Independent Contractor Agreement Template Download Wise

My Employer Says I M An Independent Contractor Does L I Cover Me

How To Read Form 1099 Misc Boxes And Descriptions By Tax1099 Com Irs Approved Efile Service Provider Medium

50 Free Independent Contractor Agreement Forms Templates

Www Clccrul Org S Legal Alert Independent Contractor V Employee Faq 46cn Pdf

50 Free Independent Contractor Agreement Forms Templates

What Are Information Returns Irs 1099 Tax Form Types Variants

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

Free Florida Independent Contractor Agreement Pdf Word

Ask General Counsel What S The Difference Between A 1099 Contractor And A W 2 Employee Business Insidenova Com

1099 Misc Tax Form Diy Guide Zipbooks

Who Should You Hire Independent Contractor Vs Employee Top Echelon

What Is The 1099 Form For Small Businesses A Quick Guide

Free Contractor Invoice Template Independent Contractor Invoice Bonsai

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Independent Contractor Taxes Guide 21

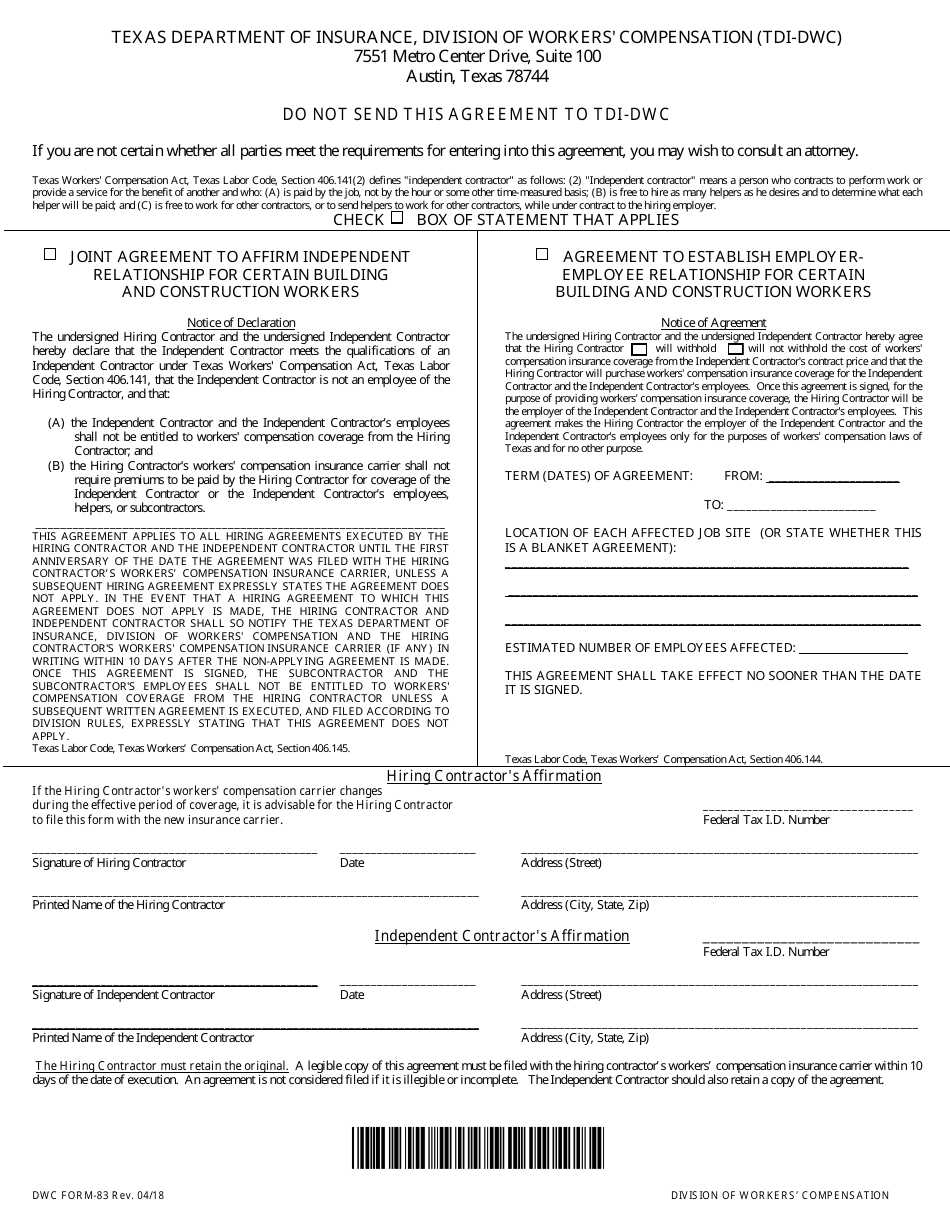

Form Dwc Download Fillable Pdf Or Fill Online Agreement For Certain Building And Construction Workers Texas Templateroller

Irs 1099 Misc Form Free Download Create Fill And Print Wondershare Pdfelement

Img1 Wsimg Com Blobby Go Ea697ce2 D2ac 417f B075 D813d4c085b3 Downloads 1bv1293ib Pdf

Free Independent Contractor Agreement Templates Pdf Word Eforms

Independent Contractor Agreement Business Taxuni

Working With Independent Contractors Business Guidelines

1099 Misc Tax Form Diy Guide Zipbooks

Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

Www Irs Gov Pub Irs Prior I1099msc 19 Pdf

Vpf Mit Edu Independent Contractor Registration Form Contractor Portion

1

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

When Is Tax Form 1099 Misc Due To Contractors Godaddy Blog

50 Free Independent Contractor Agreement Forms Templates

1099 Misc Instructions And How To File Square

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

What Is A 1099 Misc Form Financial Strategy Center

7 Independent Contractor Invoice Templates Pdf Word Free Premium Templates

Free Tattoo Artist Independent Contractor Agreement Pdf Word

Acknowledgment Of Independent Contractor Template By Business In A Box

Free Independent Contractor Non Disclosure Agreement Nda Template Pdf Word

U S Tax What Is An Irs 1099 Misc Form Freshbooks Blog

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Form Copy B Recipient Zbp Forms

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Policy Ucop Edu Doc

Independent Contractor Agreement For Programming Services Template By Business In A Box

55 Small Business Ideas Business Proposal Template Business Proposal Sample Free Proposal Template

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Free Independent Contractor Agreement Templates Word Pdf

How To Fill Out A W 9 19

1099 Misc Software 2 Efile 449 Outsource 1099 Misc Software

Www Cityofwestlake Org Documentcenter View 3653

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

5 Things To Know Before Hiring A 1099 Employee

Everything You Need To Know About Paying Contractors Wave Blog

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Use Our Compliance Checklist To Minimize Contractor Risk Mbo Partners

Printable 1099 Form 18 Brilliant 1099 Form Independent Contractor Models Form Ideas

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

Independent Contractor Agreement Example

Independent Contractor Agreement

/i-received-a-1099-misc-form-what-do-i-do-with-it-398610-v2-5bc4c1b8c9e77c00514dd003.png)

F 1099 Misc

F R E E C O N T R A C T O R F O R M S T O P R I N T Zonealarm Results

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

Www Brotherhoodmutual Com Resources Safety Library Risk Management Forms Independent Contractor Sample Agreement

Form 1099 Nec Form Pros

Protecting Rights To Ip As A Freelance Worker Or Independent Contractor

3

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime